Accountants reduce the asset's carrying amount by its fair value. Many companies consider write-offs of some of their long-lived assets because some property, plant, and equipment have suffered partial obsolescence. Such charges are usually nonrecurring, and may relate to any type of asset. However, in most countries the life is based on business experience, and the method may be chosen from one of several acceptable methods.Īccounting rules also require that an impairment charge or expense be recognized if the value of assets declines unexpectedly. The rules of some countries specify lives and methods to be used for particular types of assets. In some countries or for some purposes, salvage value may be ignored.

Depreciation is a process of deducting the cost of an asset over its useful life. Depreciation is any method of allocating such net cost to those periods in which the organization is expected to benefit from the use of the asset. Such cost allocated in a given period is equal to the reduction in the value placed on the asset, which is initially equal to the amount paid for the asset and subsequently may or may not be related to the amount expected to be received upon its disposal. One such cost is the cost of assets used but not immediately consumed in the activity. In determining the net income (profits) from an activity, the receipts from the activity must be reduced by appropriate costs.

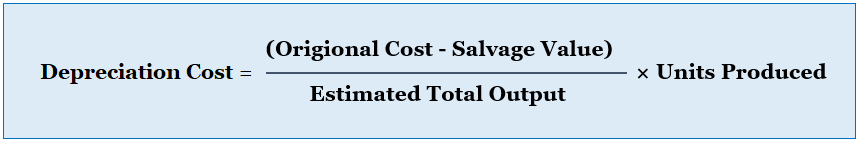

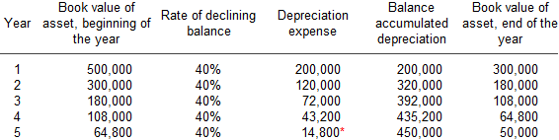

Causes of depreciation are natural wear and tear. It does not result in any cash outflow it just means that the asset is not worth as much as it used to be. For example, a depreciation expense of 100 per year for five years may be recognized for an asset costing 500.ĭepreciation has been defined as the diminution in the utility or value of an asset and is a non-cash expense. Depreciation expense generally begins when the asset is placed in service. There are several standard methods of computing depreciation expense, including fixed percentage, straight line, and declining balance methods. These may be specified by law or accounting standards, which may vary by country. Methods of computing depreciation, and the periods over which assets are depreciated, may vary between asset types within the same business and may vary for tax purposes. Generally, the cost is allocated as depreciation expense among the periods in which the asset is expected to be used.

The decrease in value of the asset affects the balance sheet of a business or entity, and the method of depreciating the asset, accounting-wise, affects the net income, and thus the income statement that they report. Businesses depreciate long-term assets for both accounting and tax purposes.

ĭepreciation is thus the decrease in the value of assets and the method used to reallocate, or "write down" the cost of a tangible asset (such as equipment) over its useful life span. In accountancy, depreciation is a term that refers to two aspects of the same concept: first, the actual decrease of fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wear, and second, the allocation in accounting statements of the original cost of the assets to periods in which the assets are used (depreciation with the matching principle). An asset depreciation at 15% per year over 20 years

0 kommentar(er)

0 kommentar(er)